Everyone has pet insurance, right?!

When I was pitching Dutch to investors, a popular retort from VC’s who passed on investing went along the lines of:

Why would anyone pay for a Dutch membership if they already have pet insurance that covered most of their needs?

This is a common refrain among VC investors who think of themselves as the common man. Most of these wealthy VC’s couldn’t believe that the pet insurance penetration rate is only 3%. Literally, they couldn’t believe me and they didn’t.

But the 3% number is easily confirmed because most pet insurance companies report the number of pets covered and it’s a matter of simple math to get to the 3% number.

There are about 150 million pets in the US and 3% of that would be 4.5 million, which is about the total amount of pets covered by the major pet insurance companies.

That’s kind of crazy when you compare that to health insurance coverage, which is over 90%.

This post focuses on how the lack of insurance in the pet market has several major consequences.

Drug prices and service costs

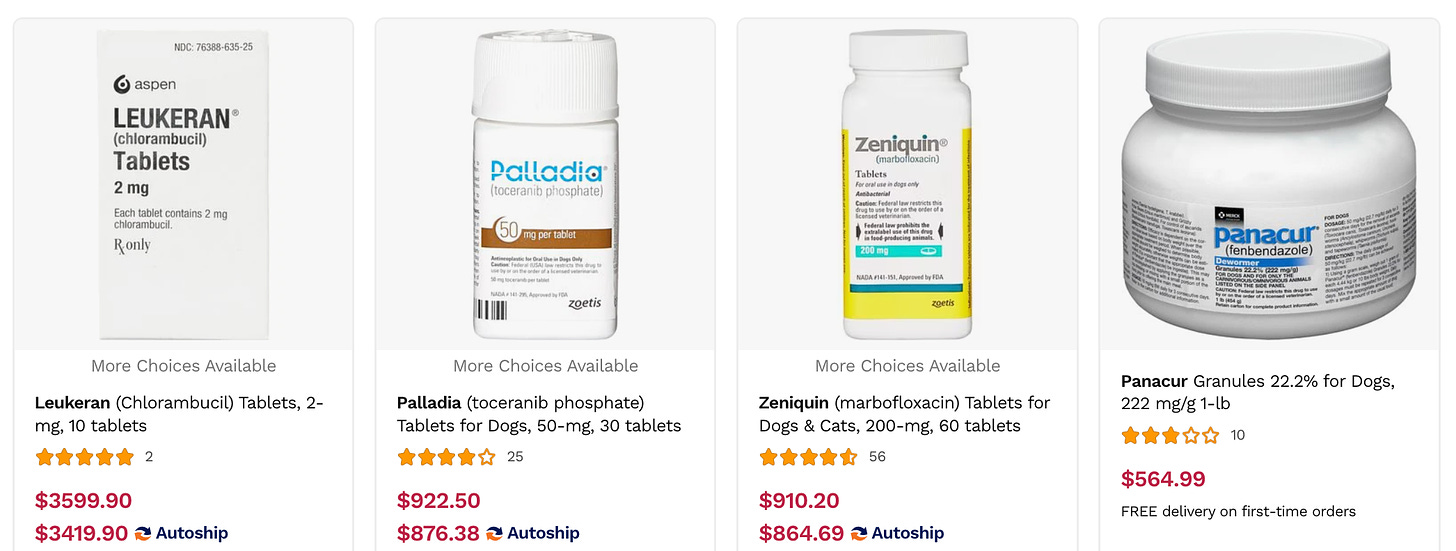

Do a search on CVS, Rite Aid or Walgreens’ online pharmacies for prices versus the Chewy, Petco, or 800PetMeds pharmacies for prices.

You can’t even find the cost of human drugs because there’s a convoluted system of millions of insurance plans, reimbursement options, out of picket minimums, etc.

On the other hand, any pet pharmacy will show you the list price of drugs, which can be easily sorted from most to least expensive.

The most expensive pet drugs are around $1,000 whereas the most expensive human drugs are in the millions of dollars.

Beyond these extremes a study in JAMA showed that for similar formulations, human medications were more expensive 93% of the time.

What’s the problem?

So, all this is great for pets, right?

Not exactly.

This is where insurance comes in (or the lack of insurance).

How come most consumers don’t feel the pain of these million dollar human drug costs? That’s because most Americans have insurance either through their employer or federal/state/local government.

As a result, the typical consumer pays anywhere from $0-40 in out of pocket costs for most drugs. The millions of dollars that drug companies make are born by hidden costs to the consumer through subsidies that either employers or governments pay for insurance and for the overall risk that is spread among the larger population.

On the other hand, pet parents, who mostly don’t have insurance, have to pay for drugs directly at cost. So when flea and tick medication costs $50 per month they have to pay those costs directly.

Furthermore, in human healthcare, insurance companies set reimbursement rates. As a result, there’s a standardization to what not just drugs, but also services cost.

In veterinary care, with the absence of insurance, the clinic can set whatever price it wants for the drugs it dispenses and the services it provides up to whatever price the market will bear. Because consumers pay the full cost in cash directly, there’s no insurance or government entity to protect consumers.

In human healthcare, insurance companies and government act as referees to limit abuse. Their absence in pet care has resulted in numerous examples that have gone viral of unexpected $10K+ bills for what seemingly should have been at most a few hundred dollars.

If everyone is losing, who’s winning?

Clinic owners. That’s why private equity has been buying up clinics at a rapid pace. It’s a consistently growing cash cow asset.

According to BLS, the average veterinarian makes $103,000 annual salary.

However, a practice owner can expect to make over $250,000 not to mention that they could sell a single location for millions of dollars.

Let’s go Dutch!

All the financial incentives in veterinary care are aligned for vet clinic ownership. That’s why some vet clinic owners are against telemedicine. They believe that telemedicine will wipe out the need for in-person visits and they will no longer reap the financial benefits from consumers.

This is complete anathema to putting pets first.

At Dutch, we see the ramifications of this firsthand. Consistently, 50% of clients who come to Dutch report that they haven’t been to a vet in 3 years or more. Quite often the issue is around affordability.

Our service is $11 per month and allows pet parents to have unlimited video calls or messages with local veterinarians around the clock.

What’s interesting is that about 20% of our patients get referred to in-person care.

So to all those worried that with telemedicine pets will never go to an in-person clinic: a) these pets are either already not going and b) telemedicine creates a front door that drives net new clients to in-person clinics.

Enough talk! What more can be done?

Pet insurance companies need to create better products so that more pets have insurance. This includes getting rid of pre-existing conditions as a limiting factor, provide lower monthly premium options, and partnering with telemedicine companies to lower costs.

Final aside

One of the reasons I liked Dutch as a brand name for our telemedicine business is that going Dutch alludes to meeting the other person halfway by splitting the bill. With that, telemedicine is when the client and healthcare provider can meet in the middle. Hence, going Dutch!

Thankfully veterinary telemedicine is becoming more common!